Interest rates: are we really reliving the 1970s?

For much of the past decade, interest rates have barely stirred from the floor. Borrowers grew used to a world where mortgages felt affordable almost by default. That world has now shifted.

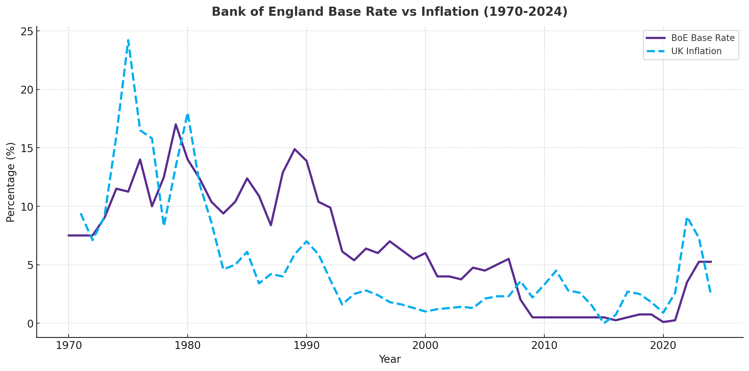

To place today’s environment in context, it helps to look at the longer relationship between interest rates and inflation. The Bank of England adjusts rates to keep inflation in check, raising them when prices rise and lowering them to encourage spending. What matters in practice is not the headline figure, but the real cost once inflation is factored in. A 5% rate in an economy where prices are climbing at 8% is a very different proposition from the same rate when inflation is low.

This explains why some periods that looked punishing on paper were, in reality, more forgiving to borrowers. And it is why today’s rates, while striking after years of ultra-low lending, must be seen in their historical frame.

The 1970s were marked by runaway inflation. In many years, prices rose faster than the Bank of England’s base rate, meaning borrowers repaid debt in money that was losing value. Lenders suffered, but borrowers benefitted.

The 1980s told a different story. Rates were pushed as high as 17% to suppress inflation, leaving mortgages deeply unaffordable even for those on solid incomes.

By the 1990s, a measure of stability had returned. Rates hovered around 5% and inflation settled near 2%. Predictable, yes. But still expensive in real terms.

Then came the extraordinary era after 2008. Successive crises drove rates to historic lows, reaching just 0.1% in 2020. Borrowers who entered the market in this period often use those rates as their benchmark, which is why anything higher feels like a shock.

At 4%, with inflation at 3.8% (published 08/25), today’s rates appear high by the standards of the last fifteen years. Yet they are modest compared with the double-digit environment of the 1970s and 80s. In real terms, borrowing costs are much closer to the long-run average than the headlines suggest.

That distinction matters. The sense that rates are “suddenly unaffordable” owes less to their level than to the expectations shaped by an anomalous decade of cheap credit. What we are seeing now is not a rerun of the 1970s, but a reversion towards historical norms.

The past decade was the outlier. Today looks more like business as usual.

For the mortgage market, that perspective is important. While affordability pressures are tangible, the broader picture shows we are not entering uncharted waters but returning to a level that has been the norm for much of modern financial history. Understanding that balance, between perception and precedent, helps frame today’s interest rate environment for both lenders and borrowers alike.